Once you've cut your spending, you can put that extra money aside into savings. Empower’s spend tracking will send you helpful alerts to keep your spending down. You can set weekly or monthly spending limits to help you better manage your money.

ONLINE HOME BUDGETING SOFTWARE FULL

Like other apps on this list, you’ll sync your external financial accounts to the app, to give you a full overview of all that’s happening in your own personal financial universe. There is a small monthly fee to use the app, but it packs a lot of features and tools that will help you gain complete mastery of your money.Īt its core, Empower is a personal finance app. But if you want a more budget-focused tool, check out the next tool on the list.Įmpower is an app that combines budgeting, building up your savings and direct financial assistance. You can customize and track your budget, of course. However, its strength is definitely investment tracking over budgeting. Since it tracks investments along with budgets, it’s a good option for getting a handle on all your finances. Personal Capital is excellent if you need an all-in-one financial dashboard. It has a great looking interface it’s easy to link your accounts, and it gives you some great insight into how you spend your money and how your investments are performing. I recommend this tool if you have 401(k), IRA or other investments to track. Personal Capital is the online tool I use to track everything from budgets to credit cards to investments. Best for holistic view of finances: Personal Capital Additionally, we tried to choose different apps that would perform a variety of functions so that you would have a selection to choose from, based on your needs.

ONLINE HOME BUDGETING SOFTWARE FREE

Included in this list are free options, as well as paid options.

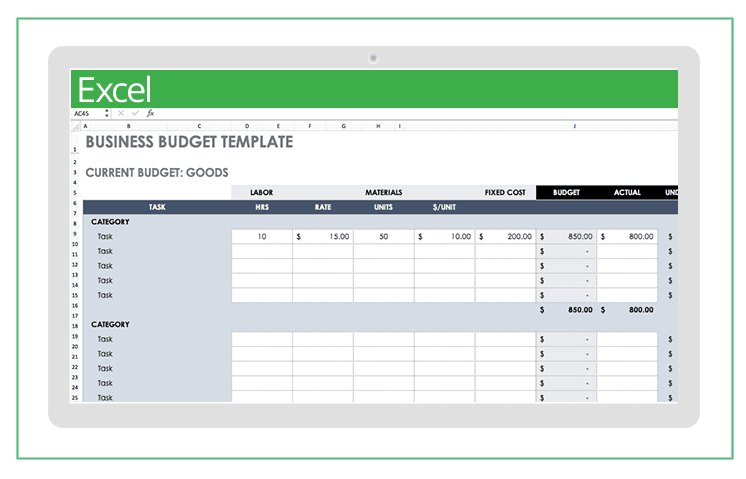

We reviewed a number of online budget tools to look for those that offer different features that might make sense for a variety of situations and budgets. Spreadsheet-based budgeting based on the envelope system

Setting savings goals and seeing if you’re ok to spend Setting spending limits and tracking your progress PocketGuard Basic: free PocketGuard Plus: $3.99 per monthįive tiers: Free, Pilot: $1.99 per month, Plus: $3.99 per month, Pro: $4.99 per month, Prime: $9.99 per month Running scenarios to project future balances for planning purposes Three tiers: Free, $9.95 per month, $19.95 per month Holistic view of finances including investmentsįree for the first 14 days for first-time customers, then $8 per month Free, with paid options for financial planning access

0 kommentar(er)

0 kommentar(er)